Listen on Spotify

Listen on Apple Podcasts

Listen on YouTube

TABLE OF CONTENTS

(00:00:00) - Introduction

(00:04:40) - $50 of Dried Lizard Venom

(00:29:17) - Fax of Death

(00:43:04) - Sleeping Beauty Awakens

(00:52:07) - Carl Icahn Sends a Letter

(01:09:19) - Endgame

(01:13:40) - Postmortem & Playbook

CREDITS

Co-hosted by Alex Kesin and Matthew Pech

Written, edited, and produced by Alex Kesin

Music: “Food” by nerowski

* Special thanks to the team at NFX for the use of their recording studio.

SOURCES

Last updated: January 2026

I. PRIMARY DOCUMENTS

FDA Regulatory Documents

Symlin (pramlintide acetate) - NDA 21-332

Byetta (exenatide) - NDA 21-773

Bydureon (exenatide ER) - NDA 22-200

SEC Filings & Financial Documents

Proxy Fight & Legal Documents

II. ORAL HISTORY & INTERVIEWS

Howard Greene Oral History (UCSD Library, October 8, 2008) - Primary source for Hybritech founding, Ted Greene’s background, and early Amylin history

III. NEWS & TRADE PRESS

2000

“The Rumsfeld Resume” - CBS News (December 28, 2000) - Donald Rumsfeld’s board tenure at Amylin (1991-1996)

“Roller Coasting” - Forbes (July 24, 2000) - Joe Cook narrative, J&J partnership collapse

2005

“Investing for a Profit and a Daughter’s Health” - NYT (March 19, 2005) - Allen Andersson investment story, “tablecloth deal”

2006

“Diabetics see hope (and weight loss) in new drug” - NYT (March 2, 2006) - “Lizzie” nickname, patient testimonials

“4 Diabetes Drugs Are Seen Raising Hope and Profit” - NYT (June 22, 2006) - Manufacturing shortage, 400,000+ patients

“Don’t kill off life-saving drugs” - Heritage Foundation (August 15, 2006) - Policy perspective on Byetta’s potential impact

“Byetta Craze Is First Salvo in Promising New Line of Drugs” - diaTribe - ADA conference chaos, “one man cried”

2007

Dr. John Eng Profile - Diabetes In Control (September 18, 2007) - Eng’s discovery story, patent struggles, Amylin vs. Lilly negotiations

2008

Xenome/Amylin Partnership - BioSpace (February 5, 2008) - Venom peptide library partnership

2009

Eastbourne Capital Sells Stake - San Diego Union-Tribune (October 10, 2009) - End of Eastbourne activist campaign

Survey: Additional Diabetes Drugs Needed - Cardiovascular Business (December 21, 2009) - Market research on GLP-1 adoption

2012

“FDA review accuses Amylin of withholding data” - FierceBiotech (June 26, 2012) - Bydureon approval controversy

IV. ACADEMIC & SCIENTIFIC SOURCES

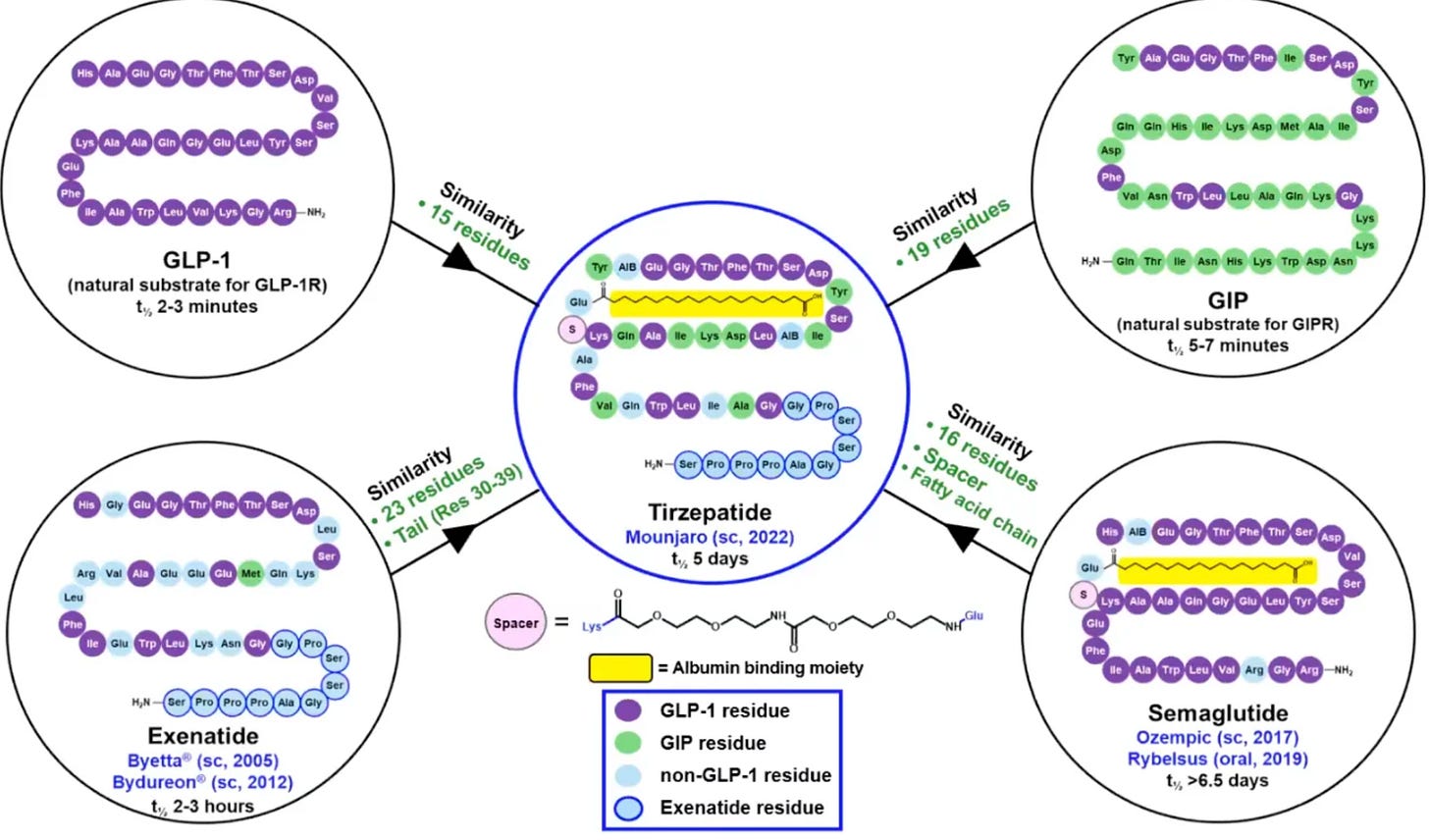

“Structural insights into multiplexed pharmacological actions of tirzepatide...” - Nature Communications (February 25, 2022) - Tirzepatide structure, exenatide C-terminus connection

“Structural and dynamic features of cagrilintide binding...” - Nature Communications (April 10, 2025) - Cagrilintide/pramlintide structural relationship

“If You Poison Us Do We Not Die?” - BYU Law Review (May 1, 2010) - Legal analysis of poison put provisions

“How GLP-1 Receptor Agonists Evolved from Diabetes to Weight Loss Treatments” - Historical overview of GLP-1 development

V. HARVARD BUSINESS SCHOOL CASES

“Amylin Pharmaceuticals: Diabetes and Beyond” (December 9, 2008) - Authors: Richard G. Hamermesh, Rachel Gordon

“Amylin Pharmaceuticals: Diabetes and Beyond” (November 2, 2012 revision) - Authors: Richard G. Hamermesh, Carin-Isabel Knoop

VI. CORPORATE DOCUMENTS & PRESENTATIONS

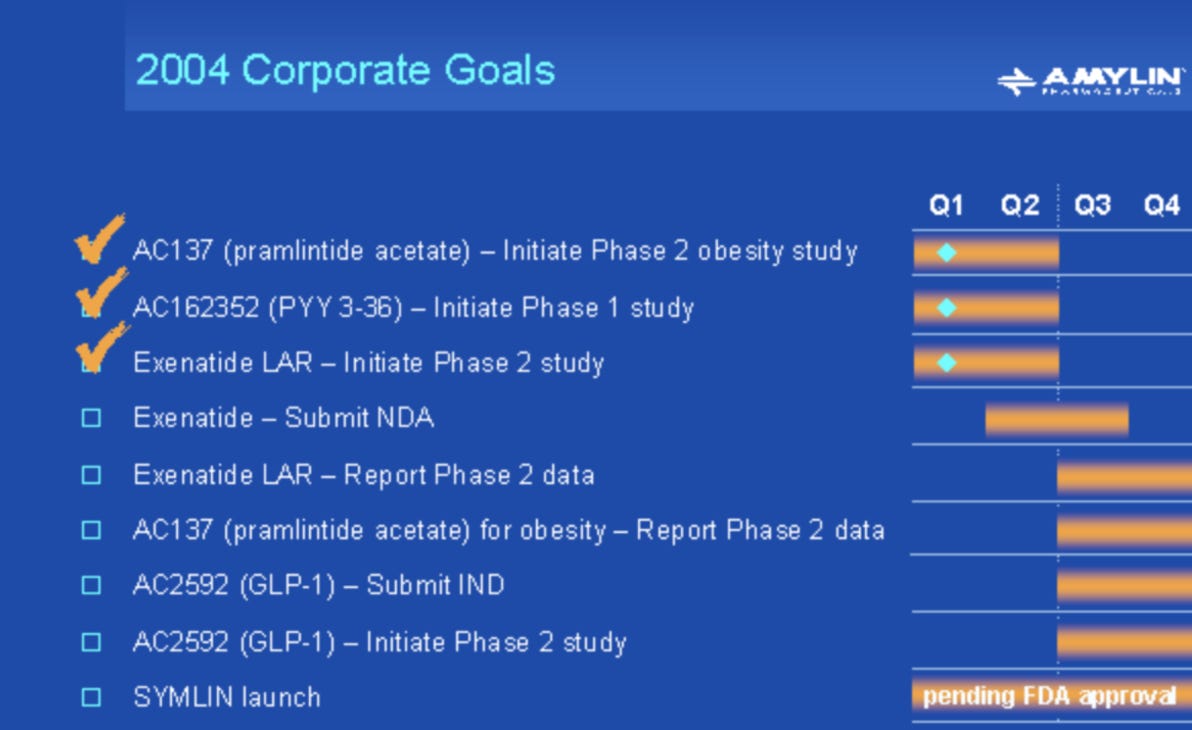

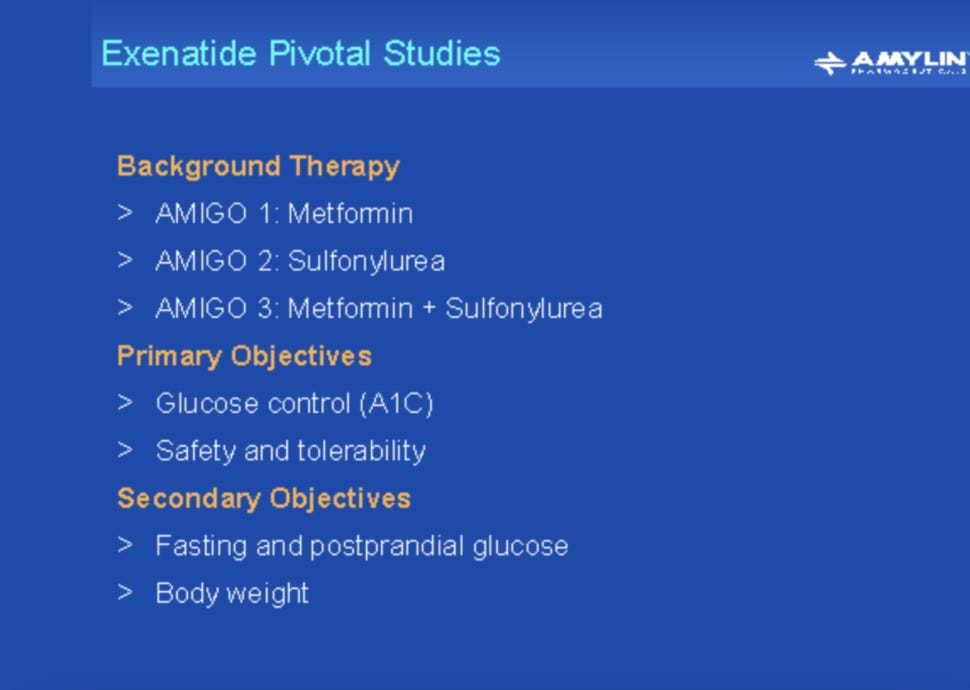

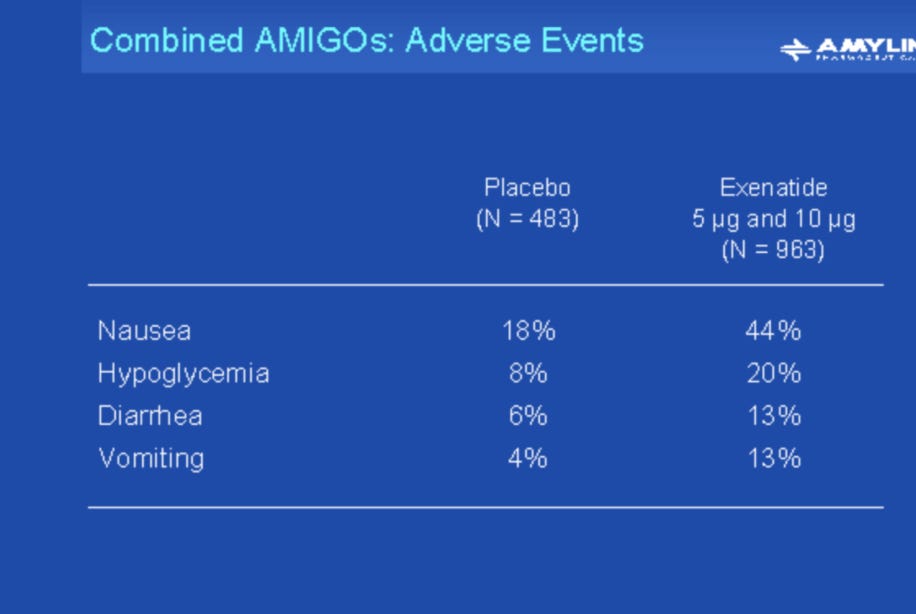

Amylin investor presentations from corporate IR archives. Specific slides referenced in the script are noted below.

Investor Presentations (Full Decks)

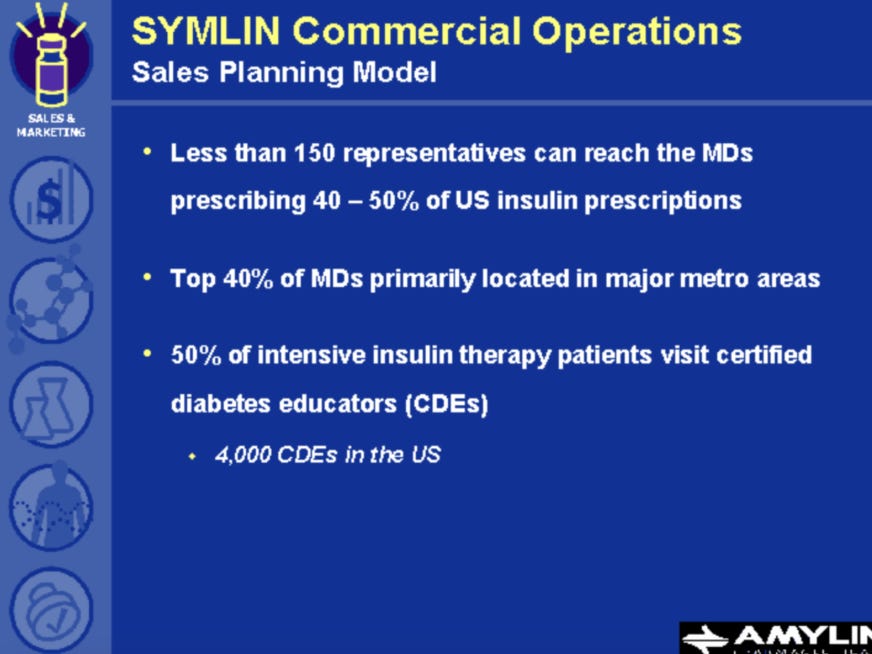

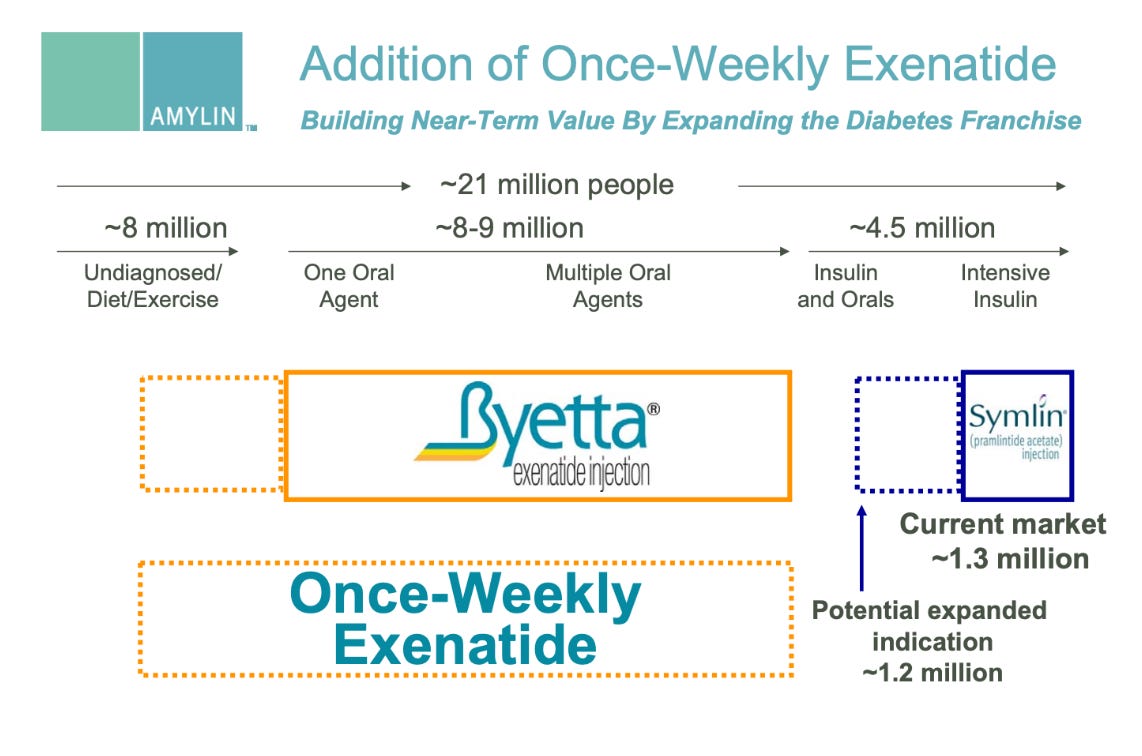

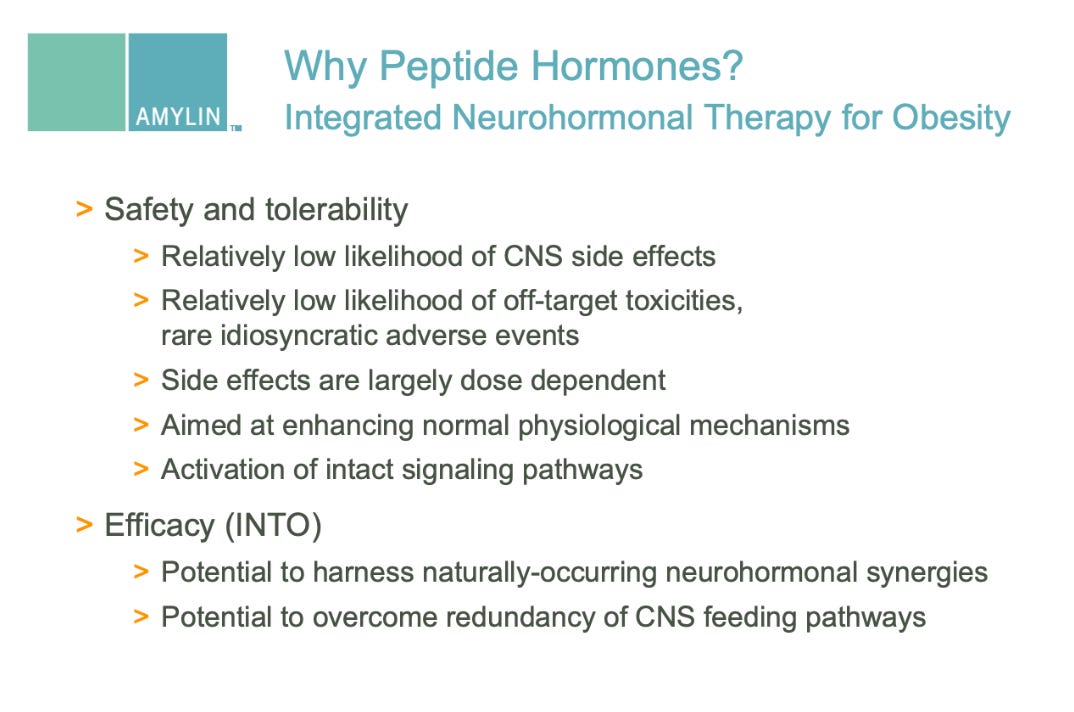

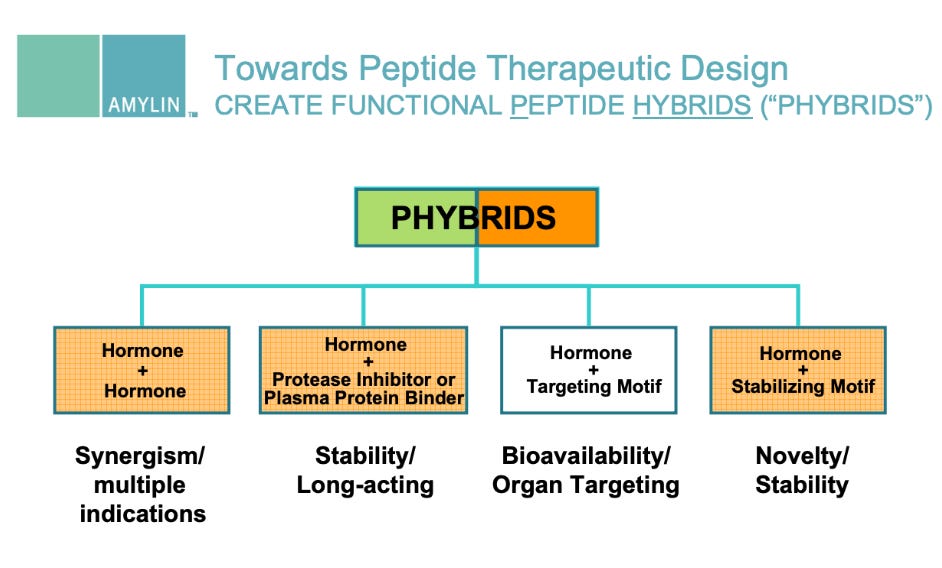

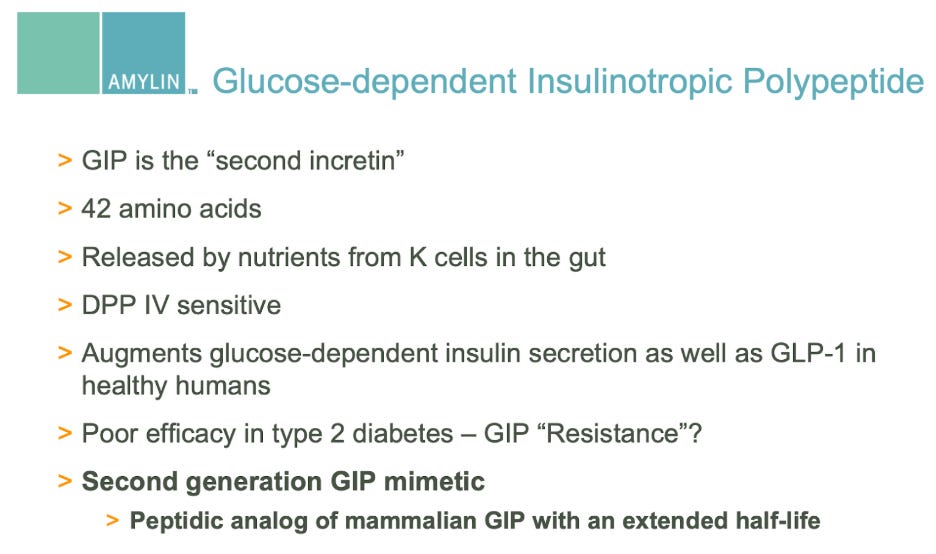

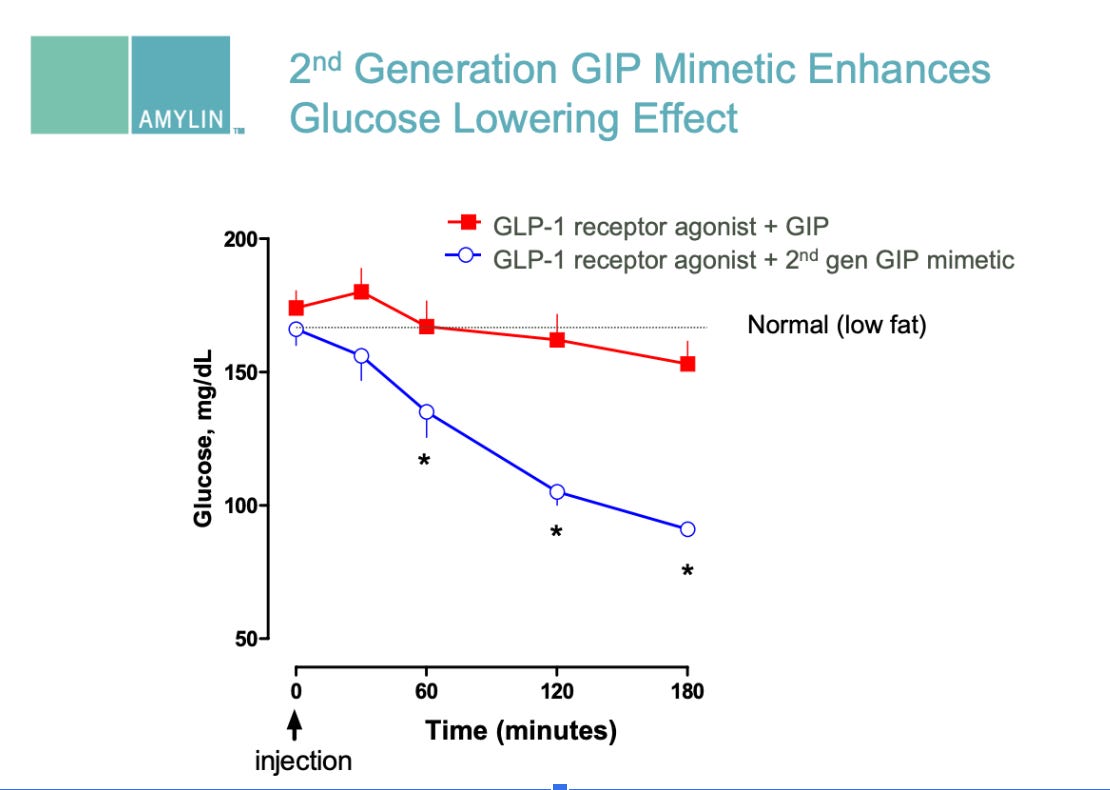

2006 R&D Day Presentation (PDF) - Phybrids platform, GIP mimetic program (slides 43, 46, 58-59)

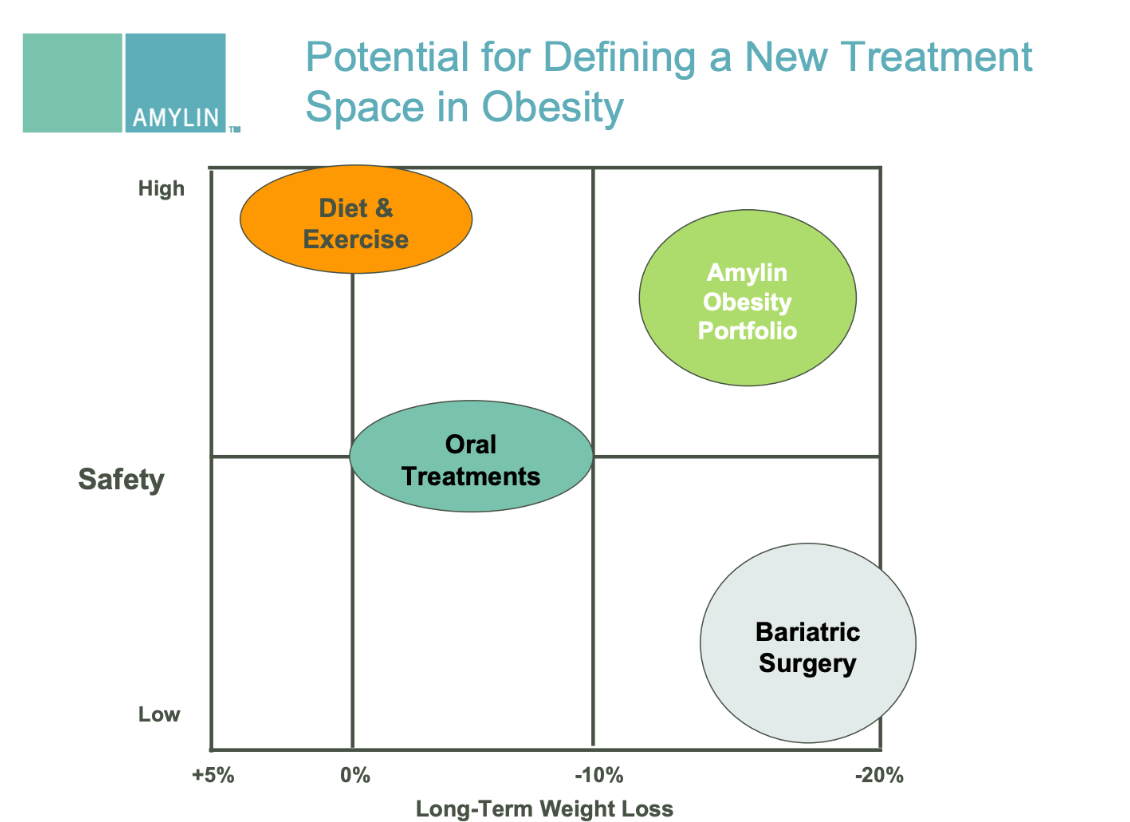

2007 R&D Day Presentation (PDF) - Market sizing, obesity portfolio positioning (slides 14, 28, 29, 78)

2007 J.P. Morgan Healthcare Conference (PDF) - Symlin Pen timeline (slide 25)

2007 Lehman Brothers Healthcare Conference (PDF) - Investor overview and pipeline update

Individual Slide Presentations (HTML Archives)

Early Corporate Presentation (WFVK) - Early-era company overview

2003 Headquarters Presentation - January 2003 corporate update

ADA IR Presentation - American Diabetes Association investor materials

VII. ADDITIONAL REFERENCES

Dan Bradbury (former Amylin CEO) - Vivani Board Profile - Now developing exenatide implant for weight loss

VIII. PRIMARY SOURCE FIGURES

IX. ANALYSIS FIGURES